Benefits of Opening Tide Business Account

Tide Bank, a financial institution, offers investment and banking services to small and individual businesses as well as non-profit organizations. The company provides checking accounts, savings accounts and certificates of deposit (CDs) and money market accounts, online banking with bill pay service for both business and personal customers. Through its Dealer Connect program, it also offers auto buyers loans or refinancing. Tide Bank offers credit cards under the Visa logo, which are accepted at any store which accepts Visa debit cards worldwide.

Home equity lines of credit (HELOC) that are available to approved borrowers can borrow as much as 80 percent of the property's value to finance qualified purposes such as debt consolidation loans, home improvement, education, and home renovations. The bank offers a variety of financial services including savings and checking, home equity loans and CD issuance. It also provides business services, such as savings and checking accounts for companies, corporations and partnerships, sole proprietors, and non-profit groups.

Additionally, it offers mortgages for real estate to professionals and consumers in the New England states, including Eastern Massachusetts. It has 31 branches throughout Eastern Massachusetts that offer its products. Another benefit of Tide Bank's products is the fact that they're backed by the Federal Deposit Insurance Corporation to prevent loss of deposit if the bank is declared bankrupt. Tide Bank also operates an Internet Website where customers can access their accounts online or transfer funds between accounts in the same branch, or to another branch across New England.

Our savings products have low interest rates, including the High-Interest Savings accounts as well as money market accounts. Our Mortgage Loans are personalized to your unique financial needs. We'll work with you to identify the right loan for your specific situation regardless of whether it's the first time homebuyers program or a down payment assistance program. We provide relationship pricing on all of our services, meaning that the more products you own that are Tide Business Account, the lower they'll cost you. Get additional savings by opening an account today!

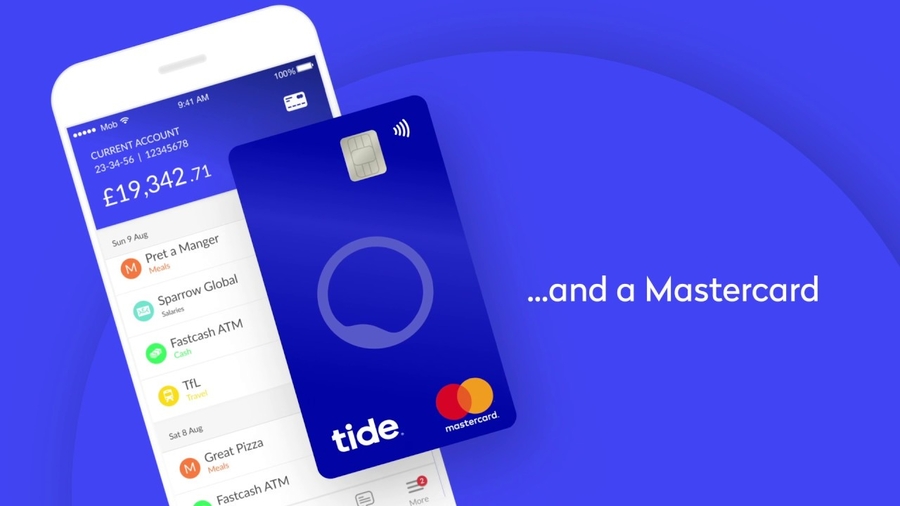

Another benefit of opening an account with Tide Business account is that additional debit cards are offered without additional cost, which means an employee or partner can also use the card, which contributes to better customer service. Tide Business accounts also offer free checkbooks. These are very convenient when you need to issue an official tax receipt or any other business-related expenses. Tide Business accounts also allow for quick transfers of funds, such as international and domestic.

Additionally, you can find ATMs, mobile apps, and online banking services at these locations. That's not to say that we at Tide don't offer all of these services, but we don't want you to think you have to look other than Tide if what you're searching for is convenience. Tide has all your needs covered here at Tide, so there's no reason to ever leave the building.

Last updated